Stock Gift

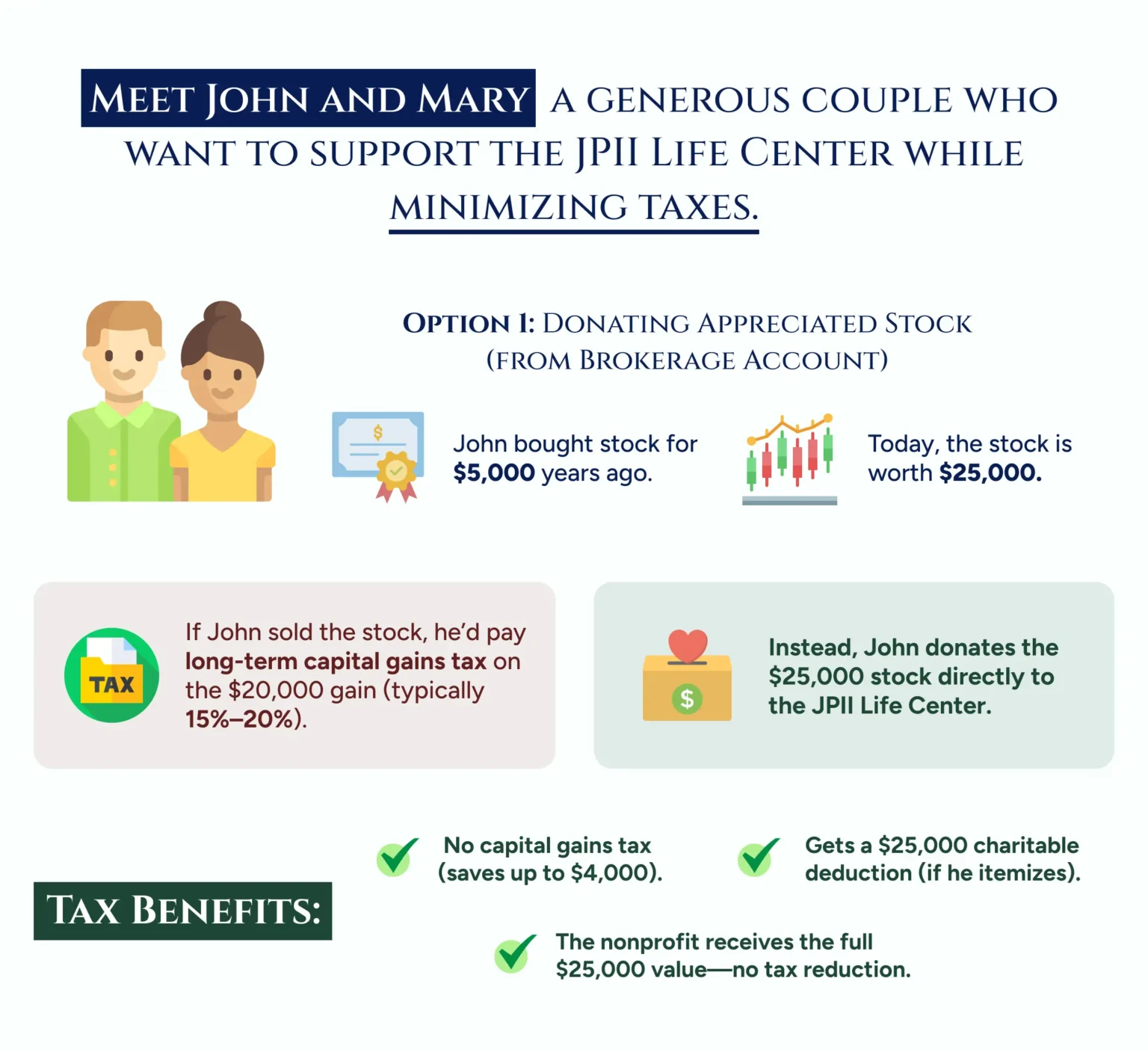

Donating stock, mutual funds, or other appreciated assets, held for more than one year, can provide significant tax savings while making a greater impact:

- Avoid capital gains tax

- Receive a charitable deduction for the full market value

Example:

Save Taxes by Donating Stock

Summary:

By donating appreciated stock directly to the JPII Life Center, John and Mary avoid paying capital gains tax on a $20,000 gain and receive a $25,000 charitable deduction. This smart giving strategy maximizes their impact while minimizing their tax burden.

Instructions for Donating Stock:

- Seek the advice of a financial or legal advisor.

- When you include the St. John II Life Center in your plans, please provide your financial advisor or bank with the following information and the total gift amount.

You will need to provide JPII with the following information:

- Type of Security.

- Number of Shares transferred.

- Your cost basis of those shares.

- Your acquisition date of those shares.

- Anticipated date of transfer to JPII.

To transfer your shares held with your broker directly to the JPII brokerage account, provide your broker/advisor with the following information:

- Legal Name: St. John Paul II Life Center

- Address: 4201 Marathon Blvd, 3rd Floor, Austin, TX 78756

- Federal Tax ID Number: 20-8785471

- Please contact [email protected] or 512-407-2900 to notify our office of your intended gift. Your information will also allow us to identify and promptly acknowledge your gift.

*Information contained herein was accurate at the time of posting. The information on this website is not intended as legal or tax advice. For such advice, please consult an attorney or tax advisor. Figures cited in any examples are for illustrative purposes only. References to tax rates include federal taxes only and are subject to change. State law may further impact your individual results.